Key Takeaways:

-

The best payment systems for 2026 will prioritize speed, security, and global flexibility.

-

Businesses are increasingly adopting AI-powered fraud detection and embedded checkout experiences to boost conversions.

-

Integrating payment data with PIM platforms helps retailers align product, pricing, and regional payment experiences for global shoppers.

What Is a Payment System?

A payment system is the technology infrastructure that facilitates the transfer of money between buyers and sellers. In eCommerce, this typically includes gateways (like Stripe or Adyen), processors (like PayPal or Square), and emerging digital payment methods (like Apple Pay, crypto wallets, or buy now, pay later platforms).

Modern payment systems now handle much more than processing. They support multi-currency settlement, fraud prevention, and embedded checkout experiences that minimize cart abandonment and improve user trust.

Use Cases

-

Online retail checkout: Integrating credit cards, digital wallets, or local payment methods.

-

B2B transactions: Automated invoicing, purchase orders, and digital procurement payments.

-

Subscription and SaaS billing: Recurring payments and dunning management.

-

Cross-border eCommerce: Handling multiple currencies and compliance with local tax laws.

In 2026, payment systems are no longer back-end utilities—they are revenue enablers that impact UX, conversion rate optimization (CRO), and even brand perception.

Why Payment Systems Matter for eCommerce

Challenge #1: Checkout Abandonment and Customer Trust

Research from the Baymard Institute shows that 17% of online shoppers abandon carts due to a complicated checkout process, while nearly 60% cite lack of trust as a reason for hesitation.

Payment systems that fail to offer familiar, secure options (like PayPal, Apple Pay, or Klarna) can quickly lose customers.

Solution: Frictionless, Multi-Method Payment Experiences

To address this, the top eCommerce platforms are implementing frictionless payment orchestration—integrating multiple gateways so customers can pay how they want. Systems like Adyen, Stripe, and Checkout.com lead this shift by allowing merchants to dynamically route payments for optimal conversion rates.

These systems also offer built-in AI-powered fraud prevention and biometric authentication, giving shoppers the confidence to buy.

The Top Payment Systems in 2026

1. Stripe – Best for Global API Integration

Stripe remains the developer favorite thanks to its robust API and global coverage in over 135 currencies. Its new 2026 update introduces adaptive AI routing, automatically selecting the best network for lower fees and higher success rates.

Use Case Example:

A fashion retailer operating across the UK, US, and EU uses Stripe’s multi-currency engine to offer local payment options like iDEAL or SEPA Direct Debit—reducing cross-border friction and improving conversion rates.

2. Adyen – Best for Enterprise-Scale Commerce

Adyen powers major brands like Spotify and Uber by offering an end-to-end payments stack—from in-person terminals to online gateways. Its unified data model provides powerful customer insights that extend beyond transactions.

Use Case Example:

A global electronics brand uses Adyen to unify in-store and online payment data, giving finance teams full visibility into real-time revenue by region.

3. PayPal – Best for Brand Recognition and Buyer Protection

Even in 2026, PayPal remains synonymous with trust. It’s especially effective for SMEs seeking quick setup, global reach, and strong dispute resolution features.

Use Case Example:

A D2C homeware retailer integrates PayPal alongside Apple Pay to build credibility among first-time international shoppers.

4. Apple Pay & Google Pay – Best for Mobile and In-App Conversions

As mobile commerce now represents over 60% of total eCommerce sales, offering native payment options like Apple Pay and Google Pay is essential. Their biometric verification enhances both security and speed, making them ideal for younger demographics and mobile-first markets.

Use Case Example:

An apparel brand uses Apple Pay integration in its iOS app to reduce checkout time by 40%, boosting completed purchases.

5. Shopify Payments – Best for Small to Mid-Sized eCommerce Stores

Built into the Shopify ecosystem, Shopify Payments simplifies setup for new merchants by eliminating third-party gateway fees. Its 2026 version includes cross-border tax compliance and multi-currency support powered by Stripe.

Use Case Example:

An independent jewelry store launches globally using Shopify Payments’ built-in currency conversion and automatic tax handling.

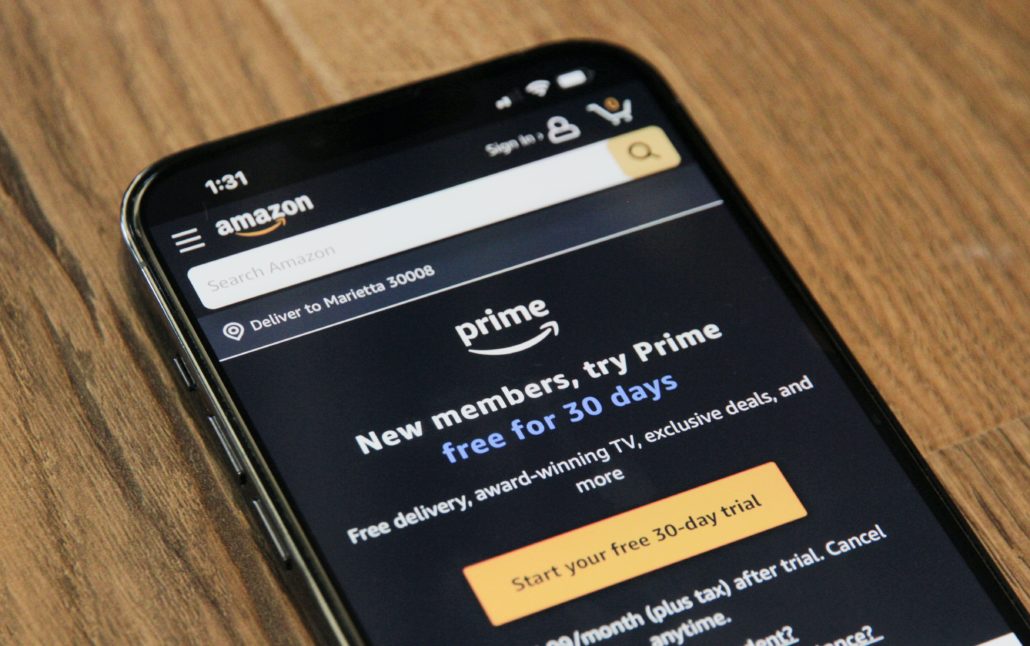

6. Amazon Pay – Best for Reducing Cart Abandonment

Amazon Pay leverages existing Amazon credentials to create a trusted, one-click experience for buyers. Since millions already store payment details with Amazon, it streamlines checkout and builds instant recognition.

Use Case Example:

A tech accessory retailer integrates Amazon Pay to capture impulse buyers familiar with Amazon’s fast, secure checkout flow.

7. Square – Best for Omnichannel Retailers

Square bridges the gap between online and brick-and-mortar sales, providing a unified dashboard for payments, inventory, and analytics. Its 2026 release integrates AI-driven demand forecasting for small businesses.

Use Case Example:

A coffee roaster uses Square for both POS and eCommerce, unifying inventory and automating loyalty rewards.

8. Klarna & Afterpay – Best for Buy Now, Pay Later (BNPL) Options

BNPL continues to expand globally, with Gen Z and Millennials driving adoption. Klarna and Afterpay help increase average order value (AOV) by letting shoppers split payments into manageable installments.

Use Case Example:

An electronics retailer integrates Klarna, resulting in a 22% AOV increase during seasonal campaigns.

9. Revolut & Wise – Best for Cross-Border Commerce

Fintech disruptors like Revolut and Wise are now entering mainstream eCommerce as payment partners. They offer real-time currency conversion and transparent international fees, making them ideal for global marketplaces.

Use Case Example:

A multi-brand retailer in Europe uses Wise to settle supplier payments across 20 countries, saving 2.5% in transaction fees.

10. Crypto & Blockchain Payments – Best for Decentralized Commerce

While still niche, blockchain-based payment systems are growing in adoption among luxury and tech brands. Solutions like BitPay or Coinbase Commerce enable crypto transactions with real-time fiat conversion.

Use Case Example:

A gaming retailer integrates Bitcoin and USDC payments to attract crypto-savvy buyers and differentiate in a crowded digital market.

Key Benefits of Modern Payment Systems

Increased Flexibility for Consumers

Offering multiple payment options ensures every shopper finds a method they trust—whether that’s a traditional credit card or a decentralized wallet. Flexibility directly correlates with higher conversion rates and repeat purchases.

Advanced Security and Compliance

The best systems in 2026 comply with PSD3, Strong Customer Authentication (SCA), and emerging global data standards. AI-powered monitoring prevents fraud while maintaining smooth user experiences.

Real-Time Analytics for Smarter Decisions

Modern payment providers give merchants rich analytics—from chargeback data to buyer demographics. When combined with Product Information Management (PIM) data, this insight helps optimize pricing, product bundles, and promotions by region.

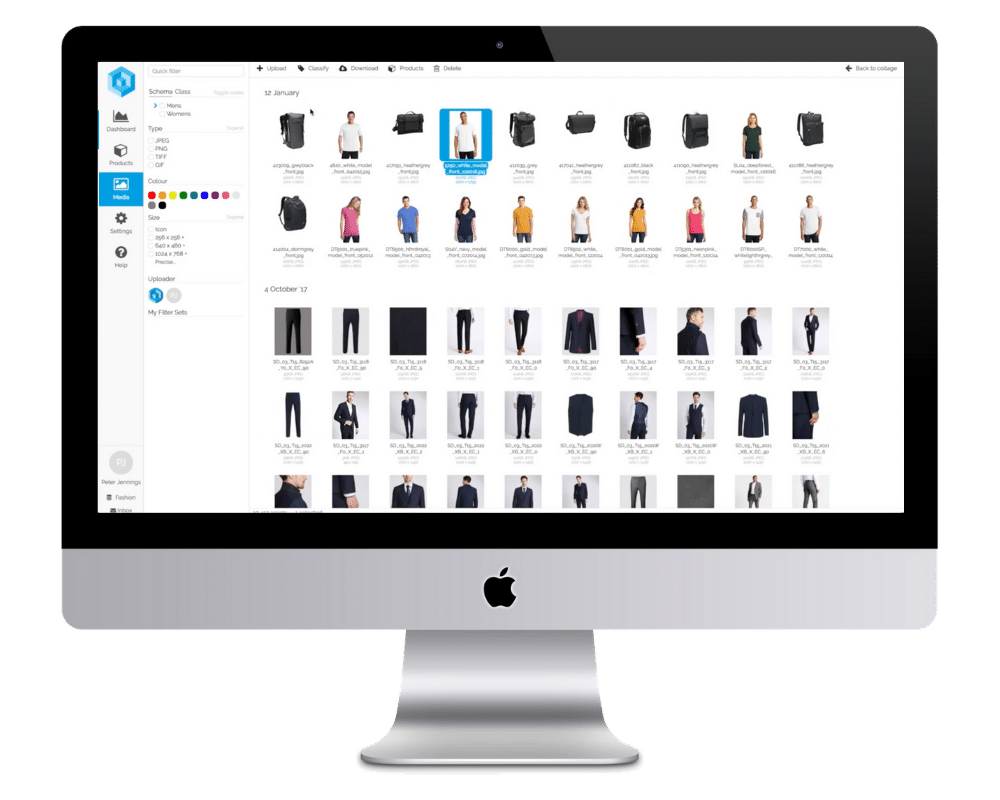

Top Payment Systems and PIM: Why Product Information Matters

While payment systems process transactions, PIM platforms like Pimberly ensure that every product listed is accurate, compliant, and ready to sell globally.

When payment data integrates with product data:

-

Retailers can localize pricing and taxes based on regional currencies.

-

Product listings automatically update with accurate availability across channels.

-

AI tools like Pimberly’s Copy AI and Image AI can personalize content based on past purchasing behavior or local trends.

For example, when a shopper in France views a product, the PIM system delivers pricing in EUR while the payment gateway ensures compliance with EU tax and payment laws—creating a seamless global commerce experience.

Learn how Pimberly helps retailers unify product, pricing, and channel data for scalable international growth.

FAQs

Q: What’s the most secure payment system for eCommerce in 2026?

A: Systems like Stripe and Adyen lead the market in security thanks to tokenization, machine learning fraud detection, and real-time compliance monitoring. For smaller merchants, PayPal and Shopify Payments also provide strong built-in protection.

Q: How do payment systems impact conversion rates?

A: Offering localized payment options and frictionless checkout can improve conversion by up to 35%, according to research from Forrester. Customers are more likely to complete purchases when their preferred methods are supported.

Q: Should small businesses invest in multiple payment systems?

A: Yes—payment diversification builds trust and expands reach. Many modern orchestration tools now let you integrate multiple gateways in one API, reducing technical overhead.

Takeaways for eCommerce Managers Looking to Stay Ahead

To summarize, the top payment systems for 2026 are not just transaction tools—they’re strategic enablers of growth. Brands that unify product data, pricing intelligence, and payment flexibility will outperform competitors on a global scale.

As AI reshapes how payments are processed and authenticated, now is the time to align your payment and product ecosystems. Integrating your PIM with payment insights can help deliver the localized, trustworthy, and frictionless experiences today’s customers expect.