A Supply Chain Transformed by Data

Traditionally, supply chains have focused on moving physical goods. Data, while important, often played a secondary role. With DPP, that dynamic flips. Product data becomes as critical as the product itself.

Here’s what that means:

- Every supply chain participant, from raw material suppliers to retailers, will need to maintain transparent, accurate, and accessible data.

- Data silos that once existed across manufacturing, logistics, wholesale, and retail can no longer be tolerated.

- The ability to trace, validate, and transfer product data seamlessly will be a new competitive differentiator.

In essence, the DPP embeds data responsibility directly into supply chain operations.

Data Accountability Across the Chain

DPP assigns clear legal responsibility, starting with the manufacturer (as the Economic Operator). But, in essence, supply chain partners are not completely off the hook:

- Raw material suppliers must provide detailed information on sourcing, environmental impact, and composition. Without this, manufacturers cannot generate a compliant DPP.

- Distributors and wholesalers must ensure that product data stays intact as products move through different channels.

- Retailers hold the ultimate responsibility to provide consumers with access to the DPP at the point of purchase.

This introduces a new layer of shared accountability. If one link in the chain fails to deliver accurate data, the entire network is at risk of non-compliance.

Implications for U.S. Brands

For U.S. brands exporting into Europe, DPP compliance is not optional. Products without compliant passports may face:

- Customs delays or outright refusal at EU borders.

- Inability to sell through certain retailers who demand compliance before onboarding products.

- Reputational risk, as consumers increasingly expect sustainability and transparency data.

Even brands that primarily sell in the U.S. should take note. Regulatory frameworks tend to spread. Much like GDPR inspired similar privacy laws worldwide, DPP is likely to shape U.S. and global standards around sustainability and product transparency.

Forward-thinking U.S. brands will treat DPP as an opportunity to modernize supply chain operations, strengthen retailer relationships, and build consumer trust ahead of competitors.

The Operational Impact: End-to-End

Let’s break down some of the operational areas most affected by DPP:

1. Procurement and Supplier Onboarding

Procurement teams will need to ensure suppliers can deliver the right data in the right format. Data quality will become part of supplier evaluation, alongside price and reliability.

2. Manufacturing

Manufacturers will need to integrate PIM systems that centralize product attributes, sustainability data, and compliance information. This ensures DPPs can be generated at scale without disrupting production.

3. Logistics and Distribution

DPP doesn’t just stop at product specs. Supply chain logistics—such as carbon footprint from shipping—may also be included. This could affect how products are transported and documented.

4. Retail and Consumer Access

Retailers will be required to present DPP information in consumer-friendly formats—whether through QR codes, NFC tags, or online portals. This will demand new integrations with digital storefronts and point-of-sale systems.

5. After-Sales and Circular Economy

DPP doesn’t end with the sale. Data around repairability, recycling, and reuse will support the circular economy, changing how warranties, spare parts, and take-back schemes are managed.

Collaboration Becomes Non-Negotiable

Historically, supply chains could operate with a degree of opacity. DPP dismantles that. Transparency is mandatory, and collaboration is the only way forward.

This means:

-

Closer manufacturer–supplier partnerships: Manufacturers will need to coach or pressure suppliers into compliance, sharing tools and best practices.

-

Stronger retailer influence: Retailers may demand standardized DPP-compliant data feeds as a condition for listing products.

-

Ecosystem-wide alignment: Industry groups and consortiums may emerge to set shared data standards, reducing duplication of effort.

For U.S. companies, aligning with European partners early will be crucial to avoid disruption.

New Costs and New Value

Compliance isn’t free. Organizations will need to invest in:

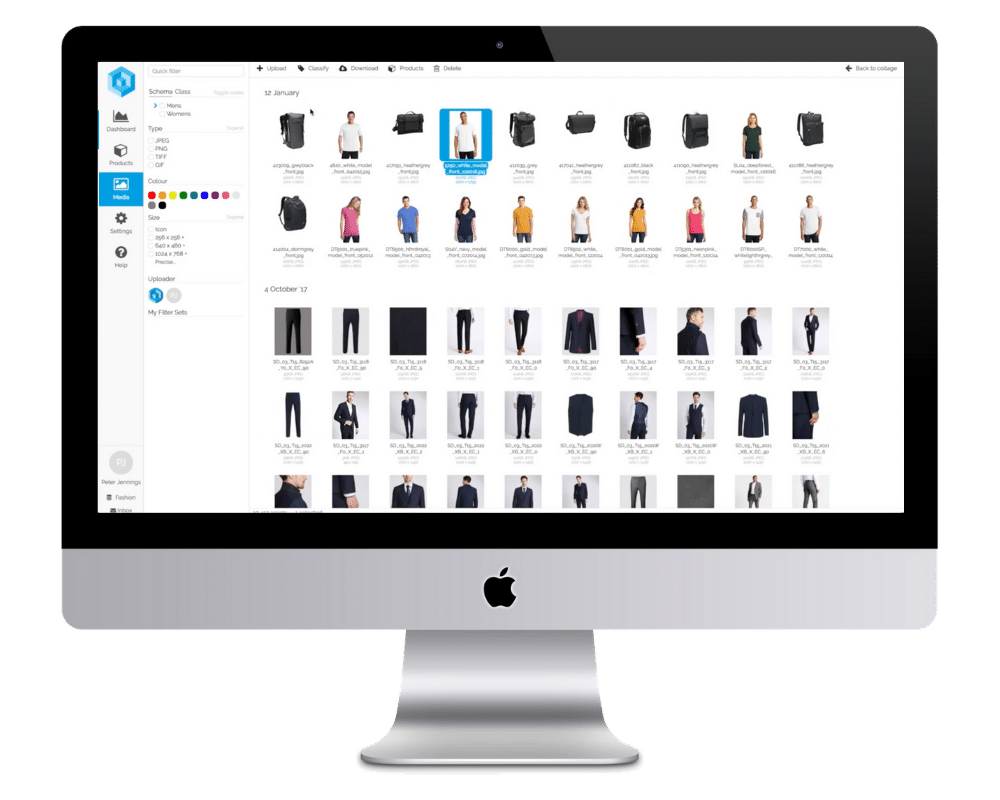

- Technology systems like PIM, DAM, and blockchain to manage and secure data.

- Process changes to capture and validate data at every stage.

- Training for staff across procurement, operations, and sales.

But the upside is just as real:

- Reduced risk of fines and product delays.

- Enhanced consumer trust through transparency on sustainability and safety.

- Data-driven differentiation, where superior data becomes a selling point with retailers and consumers.

The brands that embrace DPP early will not only stay compliant but also unlock strategic advantages across their supply chains.

Marketplaces and Global Sales

Marketplaces remain a special case. As in the first blog, DPP legislation does not impose new obligations on marketplace operators, instead deferring to the Digital Services Act.

This has global implications:

- U.S. brands selling into EU marketplaces like Zalando or OTTO must still provide DPP-compliant data.

- Amazon and other global players may create new onboarding requirements for EU sellers to ensure compliance.

- Non-compliant sellers risk losing access to lucrative channels.

Even if U.S. brands are not directly targeted by DPP within the U.S., they will feel the ripple effects through marketplace dynamics and retailer expectations.

Preparing the Supply Chain: A Practical Checklist

For supply chain leaders—whether in the EU or U.S.—the time to act is now. Here’s a framework to get started:

- Map your supply chain: Identify every partner involved in data creation, transformation, and delivery.

- Assess data readiness: Audit your current product data against anticipated DPP requirements.

- Engage suppliers: Open conversations about their ability to provide compliant data.

- Invest in technology: Prioritize PIM systems and integrations that support scalable DPP generation.

- Establish governance: Define who owns data quality, how it will be monitored, and how changes will be communicated across the chain.

- Educate stakeholders: Train teams across procurement, operations, and sales to understand their role in DPP compliance.

The Future Supply Chain Is Transparent

DPP is not just a European compliance issue—it’s a global supply chain revolution. By embedding legal responsibility for product data into every stage of the lifecycle, it changes how companies source, manufacture, distribute, and sell products.

For EU businesses, the implications are immediate. For U.S. brands, the challenge is twofold: comply with EU standards today while preparing for similar frameworks that may soon follow at home.

The winners will be those who embrace transparency, invest in data infrastructure, and foster stronger supply chain collaboration. The losers will be those who see DPP only as a burden, rather than as an opportunity to build resilience and trust in an increasingly data-driven economy.

Looking Ahead in the Series

In the next article, we will focus on how we’ll begin creating sector-specific DPP content—tailoring insights for industries such as apparel, electronics, and home goods. We will also explore why data quality will be the key to future success. Manufacturers that can provide rich, accurate, and compliant product data will not only meet regulatory requirements but also use it as a true competitive advantage across their markets.