Whenever I speak with builders’ merchants and manufacturers, the same theme comes up again and again: product information management.

It might not sound exciting, but poor product information is one of the biggest barriers holding this sector back. For builders’ merchants, inaccurate or inconsistent data creates problems at the trade counter and online. For manufacturers, product launches are delayed and supplier relationships strained.

When you add it all up, poor product data costs far more than wasted admin time. It leads to duplication of effort, higher returns, and missed sales opportunities across the building materials supply chain.

“I’ve lost count of how many times I’ve seen stock sitting in warehouses ready to go but unable to launch because the product data isn’t ready.”

Why Builders’ Merchants and Manufacturers Waste Time on Duplicate Product Data

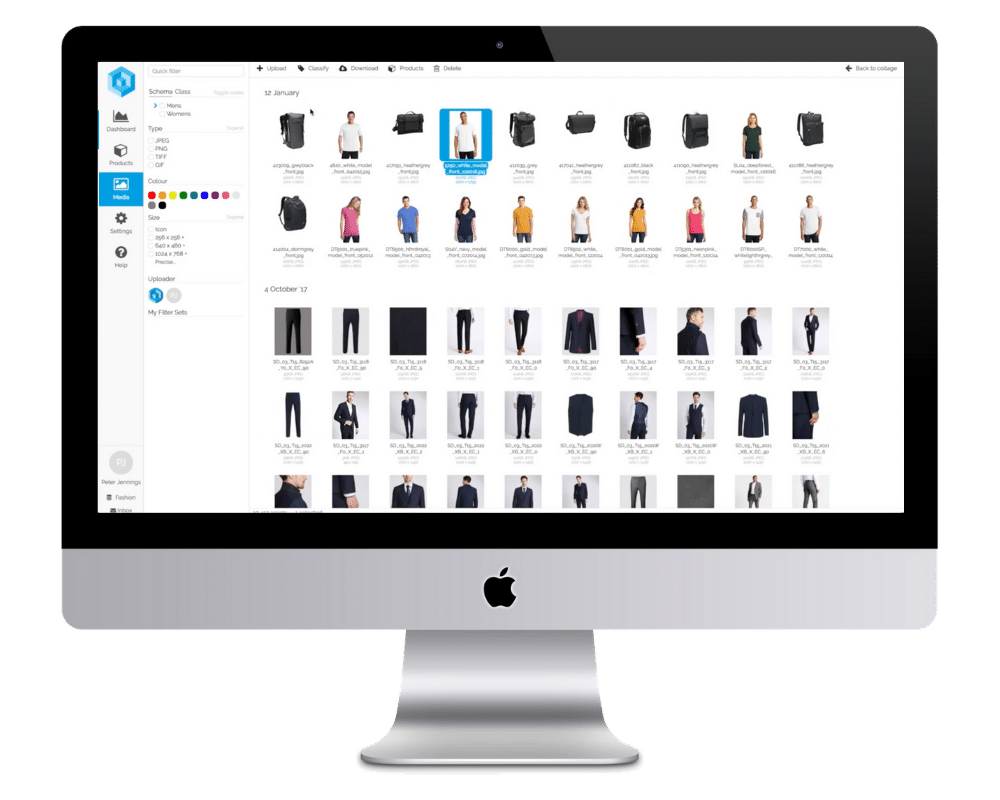

One of the biggest issues I see is duplication of effort. Merchants often have multiple teams maintaining their own spreadsheets, while manufacturers have technical, product, and sales departments all working on overlapping sets of information.

Every time a detail changes — whether it’s dimensions for a building product, an updated spec for a boiler part, or new imagery for a bathroom suite — it has to be updated in several different places. That means hours spent copying and pasting the same information instead of focusing on activities that add real value.

A good starting point is to identify where your best-quality product data currently lives. For many businesses, that turns out to be the website, because it’s customer-facing. Using that as a foundation makes it easier to reduce duplication and create a clearer “single version of the truth.”

Delayed Product Launches in Manufacturing and Merchants Caused by Poor Product Data

I’ve lost count of how many times I’ve seen stock sitting in warehouses ready to go but unable to launch because the product data isn’t ready. Descriptions are incomplete, dimensions don’t line up, or the imagery just isn’t there.

A lot of businesses hold back until they reach what feels like a “utopian state” with their product data. I understand the instinct — no one wants to put out inaccurate information — but the longer the wait, the greater the cost.

Defining what a “complete” product record looks like for your business makes a big difference. If you know the essential fields you need before a launch, you can focus on getting those right rather than holding everything back until it feels perfect.

How Inaccurate Product Information Affects Builders’ Merchants at the Trade Counter

Poor product data doesn’t only create issues online. It has a very real impact in-branch too.

I’ve seen trade counter staff trying to help customers but unable to answer basic questions because the right details aren’t available in the system. It might be a weight, a dimension, or a compatibility spec. Without that information at their fingertips, they’re left stuck.

Given the size of product ranges and the turnover in these roles, you can’t expect staff to know everything. They rely on having accurate information surfaced quickly. If that fails, the customer leaves frustrated — and often heads straight to a competitor.

That’s why merchants need to think about product data as something that supports both online and offline customer experiences.

Product Data Challenges Between Manufacturers and Builders’ Merchants

Poor quality product data also puts pressure on supplier relationships.

Manufacturers often complain that they’ve already sent product data across, while merchants reply that it arrived in the wrong format or missing key details. The result is weeks spent reworking information before products can be listed.

Merchants, in turn, are frustrated when they can’t launch ranges as quickly as they’d like because suppliers haven’t provided data in a usable way. What should be a collaborative process ends up being a drain on time and energy for both sides.

The answer here is transparency. If you agree with your suppliers on what “good” product data looks like and set minimum requirements upfront, both sides can avoid unnecessary back-and-forth.

The Hidden Costs of Poor Product Data: Returns, Lost Trust, and Missed Sales

The most obvious effects of poor product data are duplication, delays, and frustration. But the ripple effects go further.

- Wrong specs mean higher returns.

- Poor descriptions reduce customer trust.

- Failing to meet the standards set by giants like Screwfix or B&Q means products don’t get listed.

These aren’t small issues — they’re barriers to growth.

Practical Steps for Builders’ Merchants and Manufacturers to Improve Product Data

No one is saying you have to overhaul everything overnight. The businesses I see making progress usually start with some simple but important steps:

- Define what “good” looks like for your organisation.

- Identify where your best-quality data already sits.

- Clarify ownership across teams so responsibilities are clear.

- Build a picture of the “ideal” product record you want to work towards.

These foundations make it much easier to reduce duplication, launch products faster, and build stronger relationships with customers and suppliers.

Final Thoughts

For builders’ merchants and manufacturers, poor product data isn’t a small operational detail. It’s the reason product launches get delayed, why staff can’t answer customer questions, and why supplier relationships become strained.

The costs add up quickly — wasted time, higher returns, lost trust, and missed opportunities. The businesses that address this now will be the ones that move faster, serve customers better, and strengthen supplier partnerships.

In a sector where competition is intense and customer expectations keep rising, getting on top of product data is one of the clearest ways to stay ahead.