Product Data Quality: 4 Ways to Enhance Product Data

Product data quality sits at the center of modern commerce. From eCommerce sites and marketplaces to ERP systems and printed catalogs, every customer interaction depends...

Published: Nov 14, 2025 Updated: Nov 20, 2025

A drop in organic traffic can feel unsettling — especially if your team relies on steady inbound demand to drive sales. But declining traffic doesn’t always mean your SEO is failing. Search behavior is shifting, SERPs are changing, and AI-driven answers are reducing clicks across nearly every industry. Retailers, construction suppliers, and automotive brands are all feeling the impact. The good news: with the right strategy and stronger product data, you can stabilize performance and recover visibility quickly. This guide explains why declining traffic happens, how it affects different types of online sellers, and which steps help you reverse the trend.

‘Declining traffic’ refers to a measurable drop in the number of users visiting your website from organic search, paid campaigns, or referral channels. Most companies focus on organic traffic because it reflects how visible their product pages and content are on Google, Bing, and now AI-driven search tools.

A decline can look like:

In 2024–2025, many brands saw traffic decreases even when rankings stayed steady. According to multiple industry analyses (including HubSpot and Search Engine Journal), zero-click searches now represent more than half of all Google queries, meaning users get answers without clicking through.

This trend heavily impacts retailers and suppliers with thousands of SKUs, because their product pages compete with richer SERP features.

Different industries see traffic declines for different reasons:

Across every category, the cause is the same: search engines reward structured, complete, and contextual product data, while brands with fragmented data fall behind.

When organic traffic goes down, conversions usually follow. Customers don’t browse the way they used to. They expect fast results and clear answers — especially in B2B settings.

For example:

If your product pages lack complete data, rich media, or structured attributes, Google and AI crawlers have less to work with. That results in fewer impressions, fewer rankings, and declining clicks — even when demand remains stable.

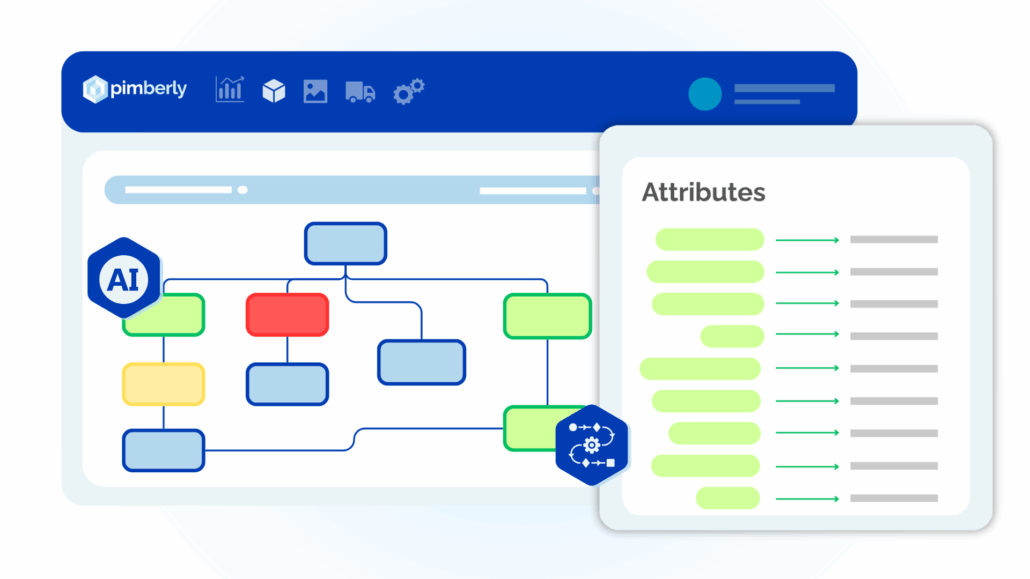

A PIM platform helps fix this at the source.

Instead of scattered spreadsheets, outdated PDFs, and inconsistent product descriptions, a PIM centralizes everything. That allows teams to:

When search algorithms favor detailed and trustworthy data, PIM provides the foundation you need to stay visible.

If you want an overview of how PIM works, you can learn what a Product Information Management system does here:

Search engines reward product pages that answer customer questions clearly. Whether you sell furniture, HVAC components, apparel, or brake pads, the more complete your content is, the more visible you become.

A PIM helps teams:

When search demand shifts, enriched products stay resilient.

A building materials supplier selling thousands of SKUs noticed declining organic traffic for long-tail keywords like “fire-rated drywall thickness” and “HVAC vent size chart.” After moving product data into Pimberly and enriching attributes, impressions rebounded because Google better understood the catalog. Product spec tables also improved, which helped category pages regain rank.

Search engines have become far more selective about which pages earn visibility. Google’s updates prioritise:

For retailers, distributors, and manufacturers, this is a challenge only if your product content isn’t centralised. A PIM turns fragmented data into structured, trustworthy content — which helps you win back traffic in several ways:

More complete attributes → more keywords → more impressions

Consistent product pages → stronger rankings across categories

Better metadata → richer SERP features

AI-ready content → improved visibility in LLM search engines

This last point matters more each month. LLMs evaluate product information very differently than traditional search engines. They pull data, not web design. That means brands with complete, highly structured product information will outperform competitors in ChatGPT, Perplexity, Bing AI, and future LLM commerce tools.

When your data is centralized in a PIM, you’re ready for that shift.

If you want deeper context on how PIM helps teams integrate with downstream systems like ERP, ecommerce, and DAM platforms, you can learn how Pimberly supports those workflows here:

A: Because search behavior has changed. Even if rankings don’t fall, users are clicking less due to AI answers, zero-click summaries, and SERP features like product carousels. This means impressions and rankings may stay flat while clicks decline. Structured and enriched product content helps you reclaim attention.

A: Not always. Some brands experience lower traffic but higher-quality visitors. But if you rely heavily on organic sessions to drive eCommerce sales, a meaningful decline can impact conversions. Strengthening product content, improving category structure, and enriching attribute data help you attract more qualified traffic.

A: Most brands see early improvements within 30–90 days if they address the root issue quickly — typically messy product information, thin content, missing metadata, or outdated category pages. Search engines respond faster when updates are comprehensive and structured, which is where a PIM provides a major advantage.

To summarize: declining traffic is becoming common across retailers, distributors, construction suppliers, and automotive brands. The shift is driven by AI answers, changing SERPs, and rising expectations around product accuracy.

But companies with clean, complete product data consistently recover faster.

A PIM helps your team:

If your brand is experiencing a dip in organic traffic or declining clicks, strengthening product information is one of the most impactful steps you can take.