Understanding the break-even point

The break-even point is the point at which total revenue equals total costs. Meaning no profit, but no loss either. Understanding the break-even threshold is crucial for financial forecasting and sound decision-making. It helps determine how many units you need to sell or what revenue you need to generate to cover your fixed and variable expenses.

For example, in investing, the break-even point is when an asset’s selling price equals its purchase cost. If you buy a stock for $200, your break-even point is also $200.

In options trading, the break-even varies by position type: for a call option with a $100 strike price and a $10 premium, the break-even is $110. For a put option, it’s $90. These calculations help traders and businesses alike assess risk and potential return.

Break-even point formula

The formula for the break-even point is as follows:

Break-Even Point (Units) = Fixed Costs ÷ (Sales Price per Unit – Variable Cost per Unit)

Fixed costs are expenses that usually don’t alter or change very little. These are consistent expenses like rent, salaries, or SaaS subscriptions.Sales Price per Unit: This is the amount that a business would bill customers for a single product that is the subject of the computation.

Variable Costs Per Unit: These are expenses that are directly related to the manufacturing of a product, such as labor or materials. Variable expenditures are usually a company’s biggest expense and are subject to frequent fluctuations.

Understanding the break-even point calculation helps with cost analysis and pricing strategy, especially when managing large product catalogs.

Understanding the break-even point calculation helps with cost analysis and pricing strategy, especially when managing large product catalogs.

So, the calculation of the break-even point is: Total variable costs ÷ Total units produced

How to calculate the break-even point

There are several different situations in which break-even points, or BEPs, might be used. Profit-volume charting allows businesses to monitor their profits or losses by examining the quantity of products sold to turn a profit. This comparison aids in establishing sales targets and determining the profitability of producing new or additional products.

Traders also use BEPs to analyze trades, determining the precise price at which a security must close to pay all trade-related expenses, such as commissions, taxes, management fees, and other charges. The calculation of a company’s break-even point involves dividing its fixed costs by the gross profit margin percentage.

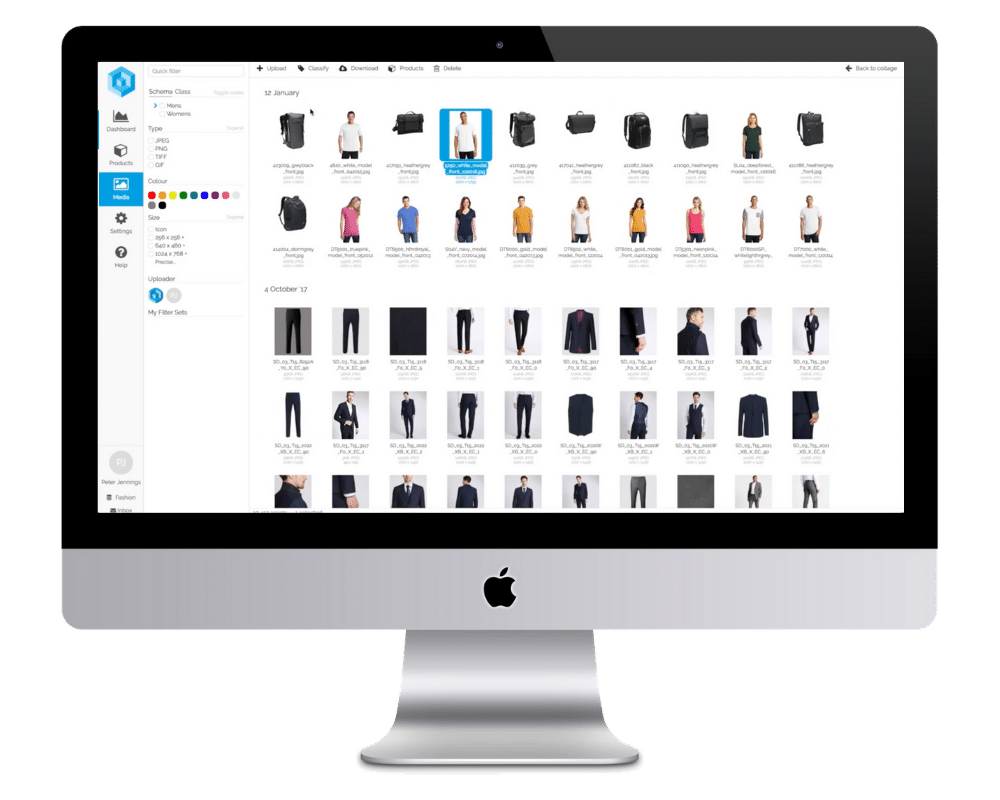

Pro Tip: With a robust PIM system, maintaining accurate cost and pricing data is seamless, making your break-even forecasting much easier.

Benefits of conducting a break-even analysis

There are several advantages to learning how to calculate your business’s break-even point. A break-even analysis can shape your business strategy and support your financial planning and cost management. Break-even analysis can greatly improve how you manage your business expenses. Here are a few of the most significant benefits of analyzing a break-even point:

Benefits of a break-even analysis:

Set Informed Pricing Strategies

Know exactly how pricing changes impact profitability, allowing for smarter, data-driven decisions. Doing a realistic study of alternative outcomes assists prospective firms in avoiding failure and mitigating the financial impact of a poorly thought-out proposal.

Control Costs Proactively

Identify and manage fixed and variable costs to stay within budget and boost profit margins. You will have a clear understanding of all of your financial obligations after completing the break-even analysis, which will reduce unpleasant surprises later on.

Plan for a Variety of Situations

Evaluate the financial impact of different business decisions before committing to a course of action. Although your emotions play a significant role, they shouldn’t dictate how you conduct business. The break-even study can assist you in launching your company with factual knowledge.

Strengthen Loan & Investment Pitches

Use insights from the break-even analysis to demonstrate your business’s viability and build trust with investors or lenders. Usually, the break-even analysis is necessary before you may take on loans or investors to finance your company. It demonstrates the viability of your idea, which will assist ease your anxiety about obtaining financing.

Create Clear Sales Targets

Determine how many units you need to sell to break-even and to achieve profitability. You’ll know precisely how much you need to sell to turn a profit after the analysis is finished. This establishes your company’s sales targets.

Minimize Risk During Launches

Ground new product launches or market entries in solid financial analysis reducing surprises and emotional-decision making. A business can determine when it, or any of its products, will begin to turn a profit by using the break-even point. A corporation is running at a loss if its revenue is less than the break-even mark. If it is higher than that, it is making money.

Common mistakes to avoid in break-even analysis

You can find your break-even point with a break-even analysis. But you can still do computations after this. You may discover that, after doing the math, you need to sell a lot more goods than you initially thought to break even.

Now is the time to assess the viability of your present plan and determine whether you require to increase prices, find a means to reduce expenses, or do both. It’s important to think about whether your products will succeed in the marketplace. There’s no assurance that the products will sell even if the break-even analysis tells you how many to sell.

To fully understand the risk involved, it is ideal for you to carry out this financial evaluation before launching your company. Stated differently, you ought to determine whether the enterprise is worthwhile. Before introducing a new good or service, established companies should carry out this analysis to see if the possible profit justifies the initial outlay.

Steps to find break-even point

You can divide the fixed costs by the margin of contribution. You may calculate the contribution margin by deducting the variable costs and the product price. Finally, you can pay the fixed costs with this amount.

Use the following calculation to get your break-even threshold in sales dollars: Sales dollars ÷ Fixed Costs ÷ Contribution Margin equals the break-even point.

Contribution Margin = Price of Product – Variable Costs

Let’s examine the formula’s constituent parts in greater detail to gain a better understanding of what all of this means:

Fixed costs: These include things like rent for production facilities or storefronts, computers, and software, which are unaffected by the volume of goods sold. Fixed costs also include fees for services like graphic design, public relations, and advertising.

Contribution margin: Subtract the selling price of an item from the variable costs to determine the contribution margin. Thus, the contribution margin is $60 if you are selling a product for $100 and the cost of labor and materials is $40. After deducting the fixed fees ($60), any remaining funds represent your net worth.

Contribution margin ratio: Deducting your fixed costs from your contribution margin yields this number, which is typically given as a percentage. From there, you can figure out what steps you need to take like lowering production costs or increasing prices to break even.

Earned profit after breaking even: You will have crossed the break-even point when your sales match your fixed and variable costs; at this time, the business will declare a net profit or loss of $0. Beyond that, any additional sales go toward your net profit.

Integrating Your Break-Even Analysis with Product Data Management

Bottom line

Calculating the breakeven point of your business expenses helps you have a clearer picture of your profit, losses, and future financial goals. You can also use effective management tools to tactfully manage your finances and data.