What is the HS code?

Harmonized System code is an industry classification system used around the globe for the export process of goods. Used by customs, it identifies products when evaluating duties and taxes.

How are HS Codes Used?

To use the HS code, you need a U.S. Schedule B number and the foreign country’s version. You can then use the code for several purposes, including:

- Classifying goods when shipping them to foreign countries

- Reporting shipments valued over $2500 or requiring a license in the Automated Export System (AES)

- Completing required shipping documentation

- Determining import tariff (duty) rates, including preferential tariffs related to free trade agreements

- Conducting market research such as trade statistics

- Compliance where applicable.

How to Identify Schedule B Codes

There is a free Schedule B search tool provided by the Consensus board that comes in handy when classifying your products. Additionally, it offers training resources and assistance. For hard-to-classify products, the Customs Rulings Online Search System (CROSS) database is best as it provides official, legally binding rulings. They utilize other exporters’ and importers’ requests to support your own.

Although it is straightforward to determine a Schedule B code in most cases, it becomes more complicated for sets. For example, while an unassembled bike is still considered a bike, some products shipped as composite goods, mixtures, and items that are sold in a set are harder to find. For instance, tracking is difficult when products like textiles are shipped as a set.

How to Identify a Foreign HS Code

Luckily, you can also find HS codes in other countries. You can use custom info databases or foreign tariff databases when determining the HS Code for your product in another country.

How it works HS code

There are several uses for HS codes. They make it possible for customs officials to recognize the item and impose the relevant import tariff in addition to other levies and trade restrictions.

The HS classification is a crucial factor in identifying the country of origin of goods. The HS classification is also used to determine both the MFN duties and the preferential tariffs under free trade agreements.

Categorization

Additionally, to ascertain the proper rule of origin under any FTA, one must comprehend the product’s HS categorization. Any trade agreement’s rules of origin will vary depending on the commodity code that a thing is classed under. Furthermore, HS categorization plays a crucial role in determining whether the commodity is eligible for different kinds of origins.

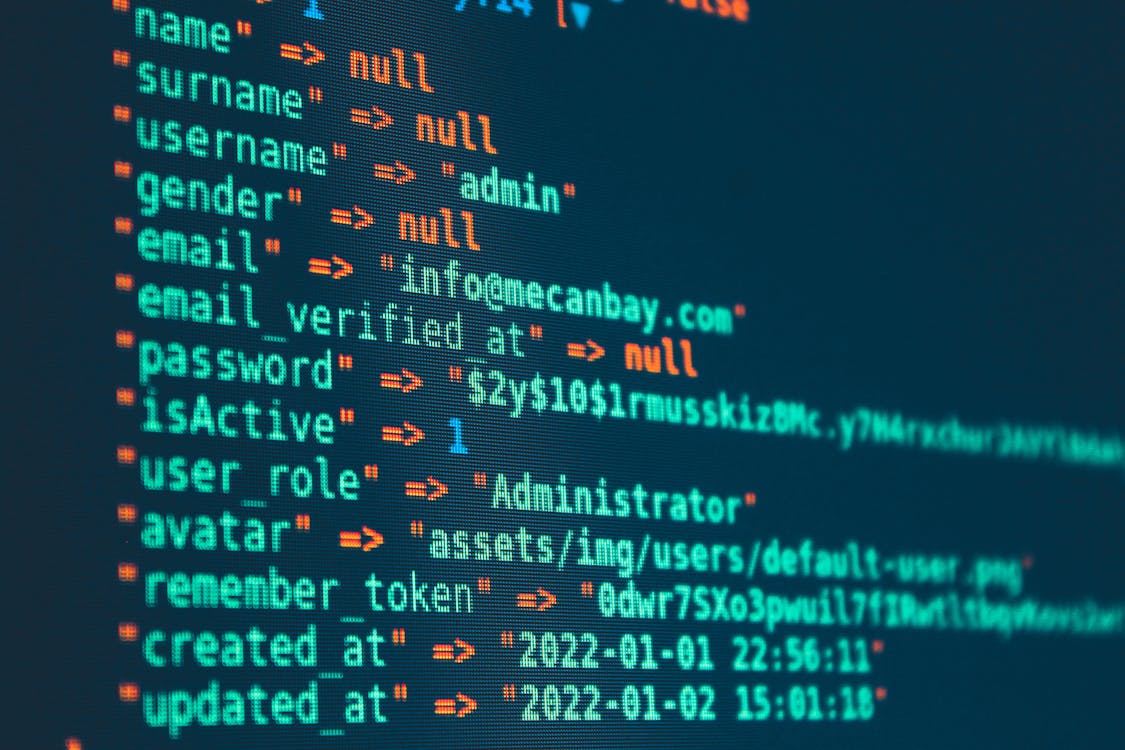

The six-digit HS code is divided into three sections: Headings (the first four digits), Subheadings (the next two digits), and Chapters (the first two digits). Depending on the nation, the HS codes are further broken down into 7- to 12-digit items (sometimes referred to as commodities codes and national tariff lines).

HS code directory

The HS designates distinct six-digit codes for different goods and classifications. For additional classification, nations are permitted to append lengthier codes to the first six digits. In turn, the HS number is the first six digits of a 10-digit code, known as a Schedule B number, that the US employs to categorize products for export. There are four parts to the US and global HS codes, explained below:

- There are 96 chapters divided into 21 different divisions. A few chapters are an exception: Chapter 77 is set aside for future use; Chapters 98 and 99 are restricted to usage within the country; and Chapter 99 is a special code that can only be temporarily altered. The chapter used here is 09, which is titled “Coffee, tea, maté, and spices.”

- The title denotes the exact category that each chapter falls under. The 01 in the previous example stands for coffee.

- The International Harmonized Code’s final two digits define product subdivisions and are more precise. Decaf coffee beans are 0901.22, while caffeinated coffee beans are 0901.21. As an aside, instant coffee would be classified as a miscellaneous food preparation under section 21.

- For classifications unique to their nation, countries may add two to four more numbers. For instance, Schedule B numbers, which are ten-digit codes, are used in the US HS code. In the example above, non-organic coffee is coded as 0050. Due to the uniqueness of these digits, non-organic caffeinated coffee from a different nation would likely have a different last four digits but the same first six.

Definition HS code

The acronym for Harmonized System Code is HS Code. It is an international index for product classification that makes uniform taxation and classification possible. Shippers can explain their goods in tremendous detail using simple numbers thanks to the HS Code’s 21 parts and several subsections.

Updates and additions to the index are made by the World Customs Organization (WCO), and they occur every five years. Nations frequently add to or modify HS codes, such as the US with its HTS codes. Use the nation-specific HS Code to estimate tariffs when importing products into a country where different versions of the code exist.

The ASEAN Harmonized Tariff Nomenclature (AHTN), which is used by ASEAN countries, uses two extra digits at the end to further split down the sub-headings. The first six digits of the AHTN are still derived from the international HS codes. Although the six-digit HS codes are also accepted, the eight-digit AHTN classification is typically used for commodities shipping within the ASEAN region.

What is a harmonized system code?

Internationally recognized codes called “harmonized codes” are used to categorize goods for taxation. Essentially, harmonized codes speed up international order shipment. They are also known as Tariff Codes, TARIC, Customs and Border Protection Tariffs, Harmonized Tariff Codes, and Harmonized System Codes. These codes are used by a nation’s customs agency to identify and determine the applicable taxes, tariffs, and fees for the goods you are sending once an order crosses international borders.

While a few nations require the description, the majority of destination countries utilize the Harmonized Code system. When exporting overseas, it is excellent practice to include a copy of the Harmonized Code and a thorough description.

Harmonized Systems Code

The Compendium of Classification Opinions, the Explanatory Notes, the Alphabetical Index, and the Brochure on Classification Decisions made by the Harmonized System Committee are among the other HS Tools that are available online as part of the HS Database (WCO Trade Tools), which compiles all of the available HS Tools.

A primary concern for the WCO is HS maintenance. This activity comprises steps to ensure consistent application of the HS and updates it regularly to reflect changes in trade patterns and technological advancements. The Harmonized System Committee (which symbolizes the Contracting Parties to the HS Convention) oversees this process on behalf of the WCO. It considers policy issues, decides on classification disputes, resolves disagreements, and drafts changes to the Explanatory Notes. Every five to six years, the HS Committee updates the HS by preparing modifications.

HS maintenance is one of the WCO’s top priorities. Consequently, this activity consists of actions to guarantee that the HS is used consistently. Also, it ensures that it is updated frequently to take into account modifications in trade patterns and developments in technology. On behalf of the WCO, this procedure is supervised by the Harmonized System Committee, which stands in for the Contracting Parties to the HS Convention. It evaluates matters of policy, renders decisions about disputes over classification, settles arguments, and writes modifications to the Explanatory Notes. The HS Committee prepares changes to the HS every five to six years.

Bottom line

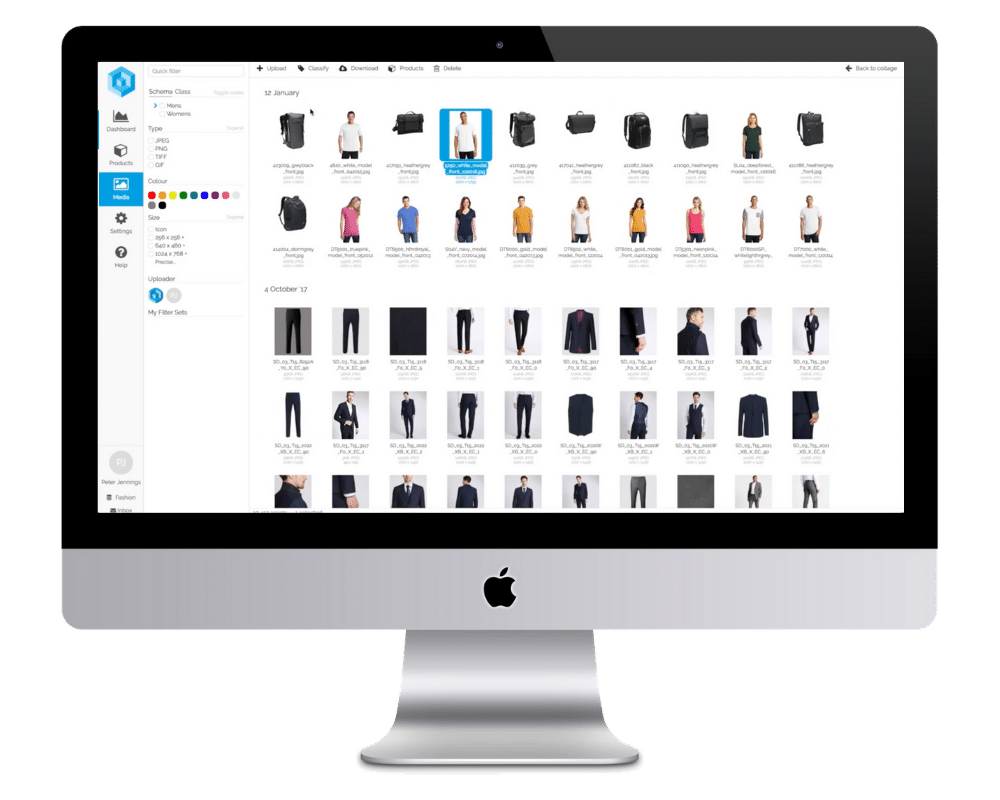

Harmonized system codes effectively help the placement and finding of products during imports and exports of any country. In addition to an HS code, using efficient management tools is also crucial for a smooth working database. If you require top-notch data management tools, contact us at Pimberly for the best services in town.